PACC received a couple who got warnings from IRD. The issue was about a 4 years’ overdue income tax returns (attached) sitting on their IRD accounts and their previous accountant failed to solve the issues.

Note: If your IRD accounts are linked with a tax agent, you will get one year extension time to file your end of year tax return. But if you plan file it by yourself, the deadline will be 7th of July.

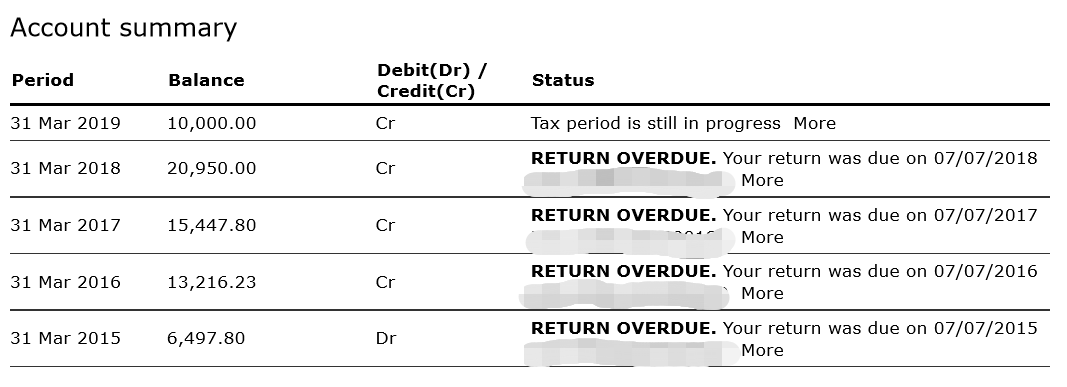

*This is their income tax account when they came to us, the returns had overdue since FY2015

PACC setup an initial meeting with the couple to understand their demands and contacted IRD immediately. After the communication, PACC applied IRD’s filing extension for the customer. However, the clients were facing financial problems, and they could not complete the large amount tax payments timely. The worst scenario would be penalties, interests or even bankrupt.

Note: IRD will base on taxpayer’s situation to make decision that how much shortfall penalty they are going to charge, from 20% – 150%

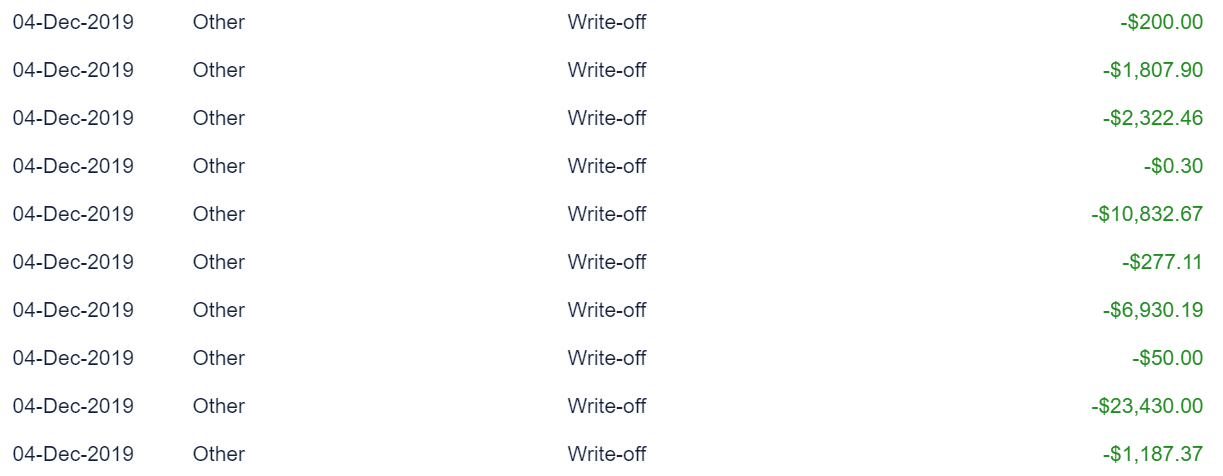

*This is client’s INC account information after all the tax returns have been filed, there were huge amount penalties and interests occurred.

PACC realized the severe situation, and raised a communication with both TMNZ and IRD. We structured a payment plan which was not only acceptable by IRD but also affordable by the customer. In addition, PACC negotiated with IRD to help the customer received over $40k penalty whiten-off, and minimized the future use of money interests. PACC completed the case before deadline, received IRD’s approval and maintained the customer’s accounts continuously.

Note: Please ask for professional advises and help when you are not sure how to communicate with IRD, this is also the better way IRD wants.

*This is the client’s INC account information, after IRD approval of $40k penalty remission

It was a hard case which had penalty, arrears and limited time. PACC treated the case in priority and solved the issues by our professional analysis and managements. PACC provides supports to customers’ business and helps them to avoid uncertainties and risks in accounting and taxation. Most importantly, PACC worked with customers to achieve a sustainable business.

The things we can learn from this case:

- Please do complete your tax obligations before deadline

- If you are getting trouble with your tax, please ask professionals help, and communicate with IRD immediately.

- The penalty and interest can be minimized when you discuss your situation with IRD efficiently and also timely.

We believe PACC can provide you a trusted guidance and comprehensive support, to avoid as many unforeseen hassles as we can. We will be the long-term business partner to the business wanting to reach final success.